Brian_B

FPS Enthusiast

- Joined

- May 28, 2019

- Messages

- 7,827

- Points

- 113

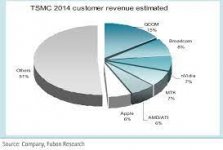

AMD Becomes TSMC's Third Largest Customer

But Apple maintains undisputable lead.

Saw this pop up on one of my feeds. Interesting breakdown. Buried in the article, this is by estimated revenue - that wouldn't necessarily be the same thing as production capacity. It also doesn't break down per process node, which would be interesting as well.

Top TSMC Customers as of December, 2021

| 2021 | |

| Apple | 25.93% |

| MediaTek | 5.80% |

| AMD | 4.36% |

| Qualcomm | 3.90% |

| Broadcom | 3.77% |

| Nvidia | 2.83% |

| Sony | 2.54% |

| Marvell | 1.39% |

| STMicroelectronics | 1.38 |

| Analog Devices | 1.06 |

| Intel | 0.84 |

The sobering part:

AMD is at ~only~ 4% on that list, and it's production is split at least 5 ways: Datacenter/HTPC CPUs, Consumer CPUs & APUs, GPUs, Sony SOCs, and Microsoft SOCs -- and there may be more custom stuff in there that isn't high profile. For all of AMD's current products, I believe they are nearly entirely sourced via TSCM, unlike say nVidia, who's got a lot over at Samsung.

Apple does make a lot of different products: A-series (iPhones), M-series (iPad/Laptops), S-series (Watch), T-Series (security), and W / H-series (Airpods). They will be making their own 5G radios soon, but don't as of yet. That said, the only customer for all of these products is Apple - no one else uses Apple silicon. Now, Apple sells a lot of phones and stuff, but it's hard to believe that it's 25% of the entire output of TSMC, especially when you look at how AMD is having to break down their allocation across various sectors.

I have no doubt Apple pays a premium to get early access to the advanced nodes and for production guarantees. This sheds a bit of a spotlight on exactly how much of a premium they are paying, as it isn't all that hard to infer quantity-wise how many products Apple is shipping.

Last edited: