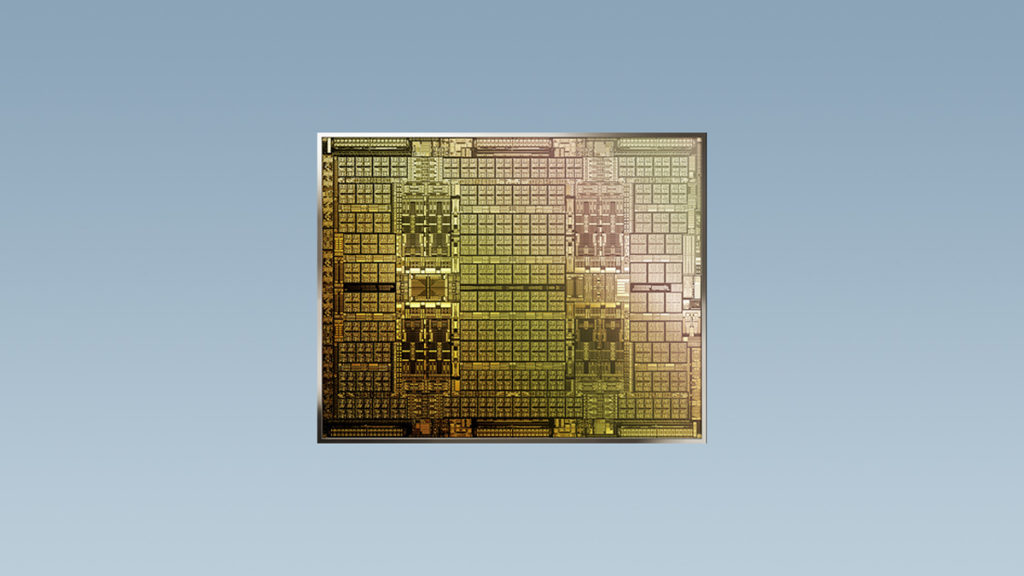

Image: NVIDIA

Cryptomining has been cited as a major factor behind the drought of NVIDIA’s GeForce RTX 30 Series graphics cards, but the actual amount of miners who are snatching up Ampere GPUs might be somewhat exaggerated. The possibility stems from recent remarks made by Executive Vice President and Chief Financial Officer Colette Kress, who spoke during yesterday’s Q4 2021 earnings call and echoed estimates from analysts who claim that cryptomining only contributed $100 to $300 million to NVIDIA’s Q4 gaming revenue. Green team managed to make a record $2.5 billion from its gaming segment in Q4 2021, so those figures, if accurate, would suggest that there are more influential factors at play behind the global GPU drought.

“Analyst estimatesuggest that cryptomining contributed 100 million to 300 million to our Q4 revenue, a relatively small portion...

Continue reading...